Important for

Prelims: Indian Economy

Mains: General Studies III

TAX ON REMITTANCES

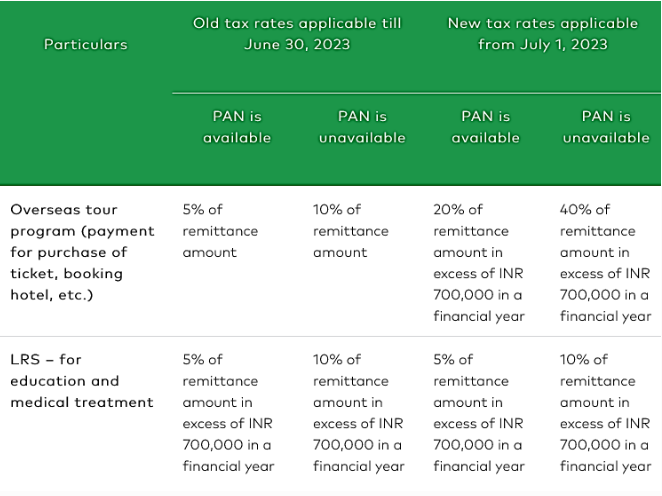

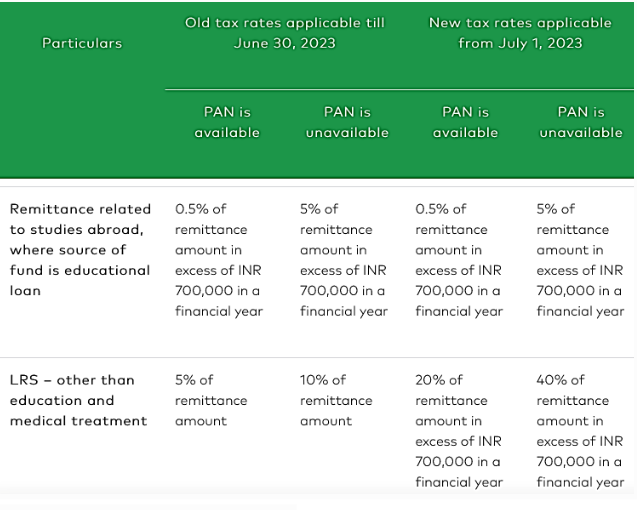

- From July 1, 2023, the tax on outbound remittances from India will increase from five percent to 20 percent, affecting funds sent overseas for vacations, investments, and gifts.

- However, it is important to note that small transactions equal to or below INR 700,000, which are made using international debit or credit cards, will be exempted from the Liberalized Remittance Scheme (LRS scheme), as per a recent clarification issued on May 19, 2023.

- While exceptions apply to educational and medical expenses, the new tax rate will be applicable to funds sent overseas for vacations, investments, and gifts, if the amount exceeds INR 700,000 per financial year.

- According to financial experts, this move is aimed at making high-net-worth individuals (HNIs) pay their fair share before leaving India permanently. In the past five years, around 30,000-35,000 HNIs have migrated to countries such as the US, UK, UAE, Canada, Australia, Singapore, and Europe. This number was 8,000 in 2022 alone.

- Earlier the use of credit cards for making payments during travel outside India was not included in the LRS limit.

- On May 16, the government amended rules under FEMA to include credit cards under LRS.

Liberalized Remittance Scheme

- The Liberalized Remittance Scheme or LRS is a measure implemented by the Reserve Bank of India to make it easier for resident individuals to transfer funds outside India.

- The LRS scheme enables outbound remittance of up to US$250,000 per financial year (April to March) for any permissible current or capital account transaction or a combination of both.

- The remittances can be made in any freely convertible foreign currency.

Issue with TCS

- Tax collection at source (TCS) is an extra amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account.

- TCS can be adjusted against the overall tax liability. It can be claimed as an income tax refund or a person can avail a credit while filing an Income Tax Return(ITR).

To read about Liberalised Remittance Scheme, click here.

Leave a Reply

You must be logged in to post a comment.