Important for UPSC, State PCS

Prelims: Most Favoured Nation (MFN) Clause . Free Trade Agreements . WTO .

Mains: General Studies Paper 2&3-Significance of Most Favoured Nation Clause and Double Taxation Avoidance Agreements in international taxation. Governance, Constitution, Polity, Social Justice, and International Relations

Context-

Recently , Switzerland has announced that it will suspend the most favoured nation (MFN) clause in its double taxation avoidance agreement (DTAA) with India, starting from January 1, 2025.

What is Most Favoured Nation (MFN) clause?

- Most Favoured Nation (MFN) – The MFN clause is a principle found in international treaties, including tax agreements, that ensures equal treatment for all parties involved.

- Equal treatment – If one country offers favourable tax rates or conditions to another, it must extend those same benefits to all other countries covered by the treaty.

- No favour – This clause is designed to guarantee that no country is treated less favourably than any other in trade or taxation matters.

- WTO MFN – MFN is applicable to WTO General Agreement on Tariffs and Trade (GATT) , General Agreement on Trade in Services (GATS) (Article 2) and the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- Exceptions – Countries can set up a free trade agreement that applies only to goods traded within the group , discriminating against goods from outside.

- They can give developing countries special access to their markets.

- A country can raise barriers against products that are considered to be traded unfairly from specific countries.

- In services, countries are allowed, in limited circumstances, to discriminate.

- But the agreements only permit these exceptions under strict conditions.

- India Switzerland MFN – Switzerland had recognized MFN status for India under its DTAA.

- India Switzerland DTAA – The Double Tax Avoidance Agreement, between India and Switzerland, was signed in 1995 and amended in December 2011.

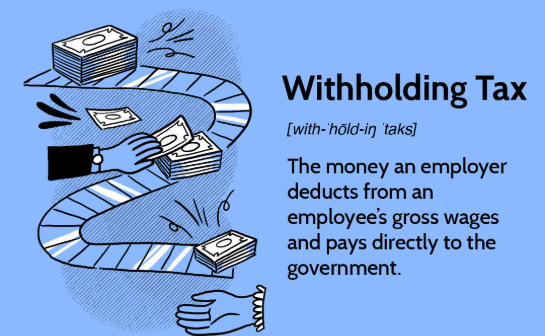

What is withholding tax?

- Withholding Tax (WHT) or Retention tax – It is an obligation on the individual (either resident or non-resident) to withhold tax when making payments of a specified nature, such as rent, commission, salary.

- IT act – The applicable withholding tax rate is prescribed in the Income Tax Act, 1961 or relevant Double Taxation Avoidance Agreement (DTAA), whichever is lower.

- Non-resident taxation – Non-residents are liable to pay taxes in India on source income, including:

- Interest, royalties, and fees for technical services paid by a resident

- Salary paid for services rendered in India

- Income arising from a business connection or property in India.

- WHT Rate – A person providing a benefit or a perquisite arising from a business or a profession can withhold tax at 10 % of the value of such benefit.

Why has Switzerland suspended the MFN clause?

- 2023 Nestle case – Swiss company Nestle had sought a refund of withholding tax paid on dividends, claiming the benefit of the MFN clause under the India-Switzerland tax treaty.

- OECD provision – The case involved the application of lower tax rates on dividends from India to countries such as Colombia and Lithuania, which had negotiated new tax terms after joining the OECD.

- Switzerland initially believed that these lower rates should automatically apply to India as well, under the MFN principle.

- Supreme court Judgement – Supreme Court ruled that such automatic adjustments require formal notification under Indian law, not just a blanket application.

- Switz reaction – As a result, Switzerland decided to suspend the MFN clause under the India-Switzerland tax treaty.

What are the impacts of MFN suspension?

- Higher tax liabilities for Indian companies – Indian companies receiving dividends from Switzerland will face an increased tax burden, as the withholding tax on those dividends will rise to 10 per cent from 5 per cent.

- Effects on Swiss investments in India – Swiss companies that receive dividends from Indian subsidiaries will continue to face a 10% withholding tax, as this tax rate has always applied under the India-Switzerland DTAA.

- No change for other DTAA benefits – Indian companies operating in Switzerland will still be able to avail themselves of the other benefits provided under the India-Switzerland DTAA, such as tax relief on royalties and fees for technical services.

- Re-evaluation of MFN clauses by other countries – This move could prompt other nations to reconsider how the MFN clause is applied in their own tax treaties with India, especially if similar legal rulings arise elsewhere.

What lies ahead?

- Aligning treaty partners on the interpretation and application of tax treaty clauses to ensure predictability, equity, and stability in international tax framework.

- Proactive negotiations to clarify and harmonise interpretations of treaty provisions are essential to safeguard Indian firms’ interests abroad.

CBL Practice Questions for Prelims –

Switzerland recently suspended India’s Most-Favored-Nation (MFN) status. Which of the following statements is/are correct regarding this development?

- MFN status is a trade designation given by the World Trade Organization (WTO) to promote equal trading relations between countries.

- The suspension of MFN status by Switzerland implies that India will no longer enjoy the same tariff treatment as other countries that hold this status with Switzerland.

- The suspension of India’s MFN status by Switzerland is a response to India’s policy on intellectual property rights and patent laws.

- MFN status, once suspended, can only be reinstated after the negotiation of new trade terms between the two countries.

Select the correct answer from the options below:

(A) 1 and 2

(B) 2, 3, and 4

(C) 1, 3, and 4

(D) 1, 2, and 3

Answer:(A) 1 and 2

CBL Mains Practice Question-

Discuss the concept of MFN status, the implications of such a suspension on bilateral trade relations, and analyze the potential reasons behind Switzerland’s decision. How can India respond diplomatically to safeguard its trade interests?

Leave a Reply

You must be logged in to post a comment.