Topic: GS-3, Resource Mobilisation, IRDAI PRELIMS

IRDAI– An Introduction

The Indian insurance sector has witnessed tremendous growth in recent years due to the establishment of the IRDAI – Insurance Regulatory and Development Authority. Established in 1999, IRDAI plays a pivotal role in safeguarding consumer interests and fostering a healthy insurance market in India. IRDAI was made a statutory body in the year 2000, formed under the Insurance Regulatory and Development Authority Act, 1999. It functions as the apex body for regulating and promoting the development of the insurance industry in India.

Key Functions of IRDAI

- Protecting Policyholders: IRDAI ensures fair treatment of policyholders by regulating insurance companies and their products.

- Promoting Competition: IRDAI fosters a competitive insurance market, which leads to a wider range of insurance products and potentially lower premiums for consumers.

- Enhancing Market Confidence: By regulating insurance companies and ensuring their financial solvency, IRDAI builds trust and confidence in the Indian insurance sector.

- Facilitating Growth: IRDAI promotes innovation and development within the insurance sector, paving the way for a more robust and inclusive market.

Benefits of Insurance Regulatory & Development Authority of India for Consumers

- Informed Decisions: IRDAI regulations ensure transparency in insurance policies, allowing consumers to make informed choices.

- Grievance Redressal: IRDAI provides a platform for consumers to address grievances against insurance companies.

- Financial Security: IRDAI’s focus on solvency ensures that insurance companies have the financial resources to meet their obligations to policyholders.

What is Bima Trinity of IRDAI?

Bima Vistaar is a revolutionary all-in-one insurance product by the Insurance Regulatory and Development Authority of India (IRDAI). The policy will offer life, health, and property coverage at an affordable premium, making insurance accessible for everyone, especially those in semi-urban and rural areas.

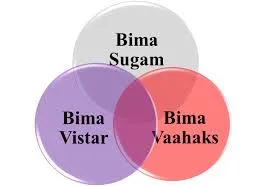

Bima Vistaar is a key component of IRDAI’s “Bima Trinity” initiative, which includes:

- Bima Sugam: A one-stop digital platform designed to simplify insurance purchase and access.

- Bima Vahak: A dedicated women-oriented distribution channel to empower women entrepreneurs in the insurance sector.

Benefits of Bima Vistaar:

- Convenience: A single policy for multiple coverages simplifies insurance management.

- Affordability: Designed to be accessible for a wider population.

- Peace of Mind: Provides comprehensive protection for life, health, and property.

Expected Launch: IRDAI anticipates launching the Bima Trinity in the first quarter of FY2025. This will lead to a significant increase in the insurance penetration in India.

Leave a Reply

You must be logged in to post a comment.