Important for

Prelims: Indian Economy

Mains: General Studies III

Indian Start-up Ecosystem

- Due to interest rate hikes of global central banks and the ongoing banking crisis in the US, startups are facing difficulties in fund-raising.

What is a Start-up ?

- A startup is defined as an entity that is headquartered in India which was opened less than 10 years ago and has an annual turnover less than Rs 100 crore

- It is an entrepreneurial venture in the early stages of operations, typically created for resolving real-life problems.

- Unicorn – It is a term given only to startups who have a valuation of over $1 billion.

- Decacorn – The startups that exceed the valuation of $10 billion are grouped under the term called decacorn (a super unicorn).

Importance of Start-ups

- Employment creation – The startups are enabling more jobs than large companies or enterprises thus curbing the unemployment problems.

- New investments – Many multinational corporations are now outsourcing their tasks to small businesses in order to focus on their core competencies.

- Research and Development (R&D) – Start-ups heavily subsidize R&D as they frequently have to deal with high-tech and knowledge-based services.

- Better GDP – It is feasible to increase revenue domestically by promoting and supporting more start-up initiatives.

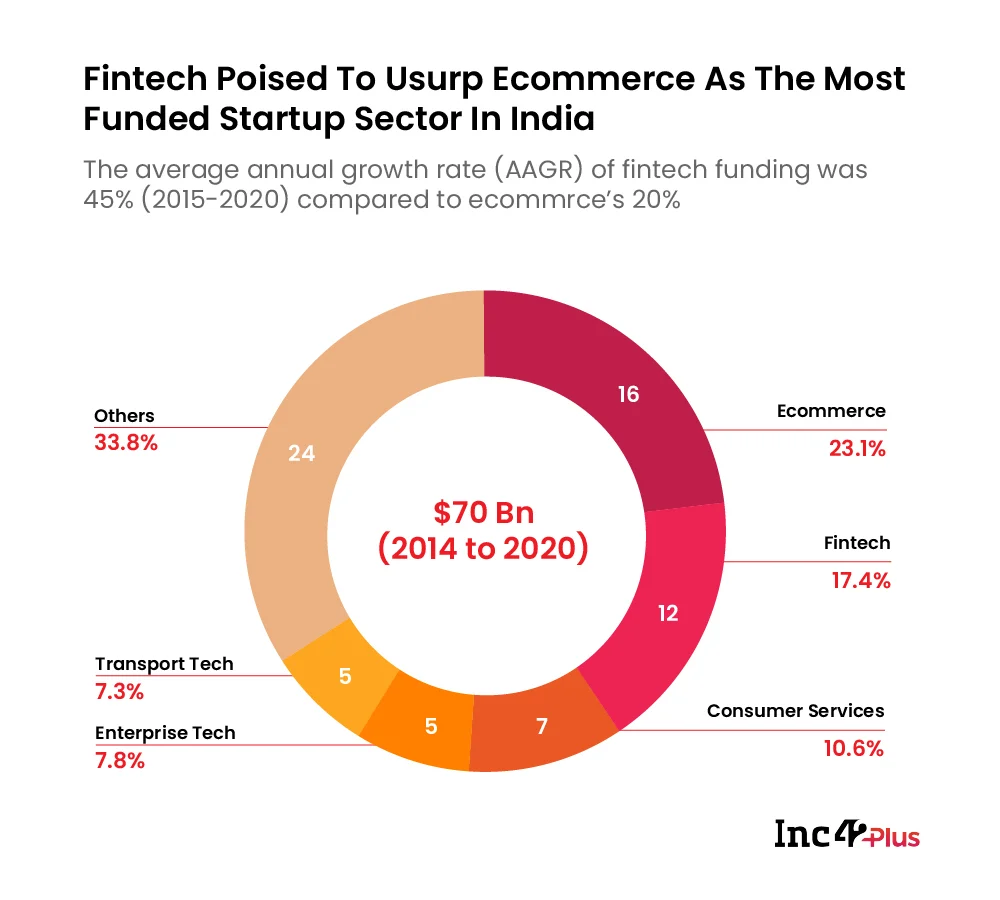

- Democratizing the technology benefits – Fintech startups are reaching out to remote areas with their solutions and making financial solutions easily accessible in tier 2 and tier 3 cities.

Reasons for Shortage of Funds

- Interest rate hikes of global central banks

- Steep correction in valuation of technology stocks

- Increased risk aversion due to ongoing banking crisis in the US and Europe

- Excessive liquidity created during the pandemic

- High borrowing cost impacting profitability, leading to massive lay-offs in this segment

- Global venture capital investors who have suffered large losses in their portfolio are unlikely to provide much funding support.

Ways to Support Start-up Ecosystem

- Policy support – The high net worth investors, investment funds and companies who have displayed a willingness to invest in fledgling companies should be channelized.

- Fiscal and regulatory policies – Investors need to be encouraged with suitable fiscal and regulatory policies to support the segment in periods when global funding dries up.

- Abolition of Angel tax – Angel tax, which requires start-ups to pay income tax on capital received at a premium to their fair valuation should be abolished, since it deters fund raising from angel investors.

- Alternate Investment Funds – Investment into Alternate Investment Funds which invest in start-ups could be incentivized through a tax concession.

- Capital Gains tax rate – Paid by resident individual investors on their start-up investment can be lowered.

- Overseas Exchanges – Indian startups should be allowed to list on overseas exchanges.

Leave a Reply

You must be logged in to post a comment.