Important for

Prelims: Indian Economy

Mains: General Studies Paper III

- Gold reserves are the amount of bullion that is held by the central bank or the treasury of the

- country or a store of value/ to support the value of the national currency.

- It contributes to the nation’s creditworthiness in the issuance of currency and bonds.

- Gold reserves that are held by the government should be distinguished from gold held by

individuals or private institutions. - Forex reserves are assets maintained by monetary authorities to check the balance of

payments, deal with the foreign exchange rate of currency and to maintain financial market

stability. - India’s forex reserves can be broken into four categories:

- Foreign currency assets

- Gold

- Special drawing rights

- Reserve Tranche Position

Context :

- The RBI has been increasing its gold reserve as part of the diversification process and a precaution to growing global financial uncertainty.

- As of financial year 2023 the RBI have 794.64 metric tons of gold an increase of nearly 5% financial year 2022.

- Of total 794.64 metric tons of gold, 437.22 tons of gold is held overseas in safe custody with the Bank of England and the Bank of International Settlements (BIS) and 301.10 tons of gold is held domestically.

- As on March 31, 2023 the country’s total foreign exchange reserves stood at USD 578.449 billion, and gold reserves were pegged at USD 45.2 billion.

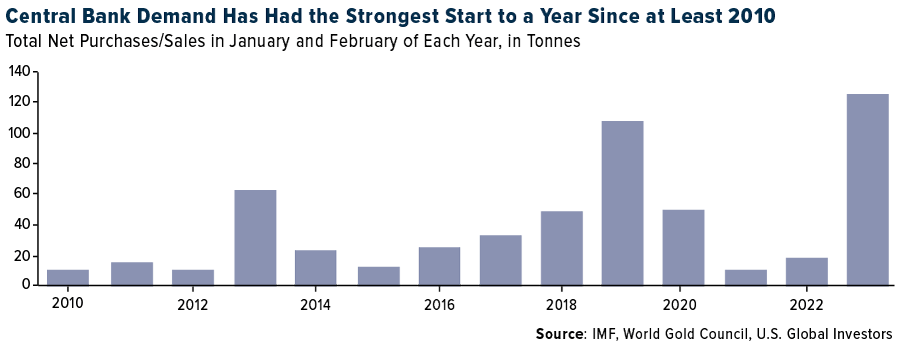

- Central banks across the world are increasing its gold reserve due to the increasing global uncertainty.

Why RBI is increasing the gold in foreign exchange reserve?

- Long term benefits – Since gold is safe and secure and liquid assets it has long term benefits.

- Diversification – RBI is diversifying its foreign exchange reserve because of the growing global uncertainty.

- Negative rates – To overcome the negative rates in the past.

- Dollar – Since dollar has been weakening against other currencies, gold can be good alternate.

- Transparency – Since gold have standard international price which is transparent.

- Low confidence in Swiss financial centers – Because of the demise of Credit Suisse.

Why gold is an important component in foreign exchange reserve?

- Commodity-linked currencies – Gold has performed even better when expressed in terms of commodity-linked currencies.

- Increasing value of gold – The rate of the gold has been increasing more than the US dollar.

- Weak global financial system – The financial system is expected to face several crisis because of more volatility.

- Foundation for the rupee – Gold reserves coupled with a strong economy, balanced current account deficit and good balance of payment lay the foundation for the rupee in long term.

Practice Questions for Prelims

______ refer to central bank purchases or sales of government securities in order to expand or contract money in the banking system and influence interest rates.

a) National market operations

b) Closed market operations

c) Open market operations

d) International market operations

Ans. c)

Leave a Reply

You must be logged in to post a comment.