Context: The European Parliament – the legislative body of the 27-member EU, reached a political deal on the carbon border tax – Carbon Border Adjustment Mechanism (CBAM).

Important for

Prelims: International Relations

Mains: UPSC General Studies II

- CBAM was first introduced as a part of the European Green Deal, which serves as a guide for both tax and non-tax policy initiatives in the EU to achieve its ambitious target of becoming climate neutral by 2050.

- This was followed by a proposal for a regulation on CBAM in 2021 as part of the “Fit for 55” policy package, aiming to reduce GHG by at least 55% by 2030, from the levels of 1990.

- It plans to impose a tariff/import duty on a set of carbon-intensive imports, which will have to be paid by EU importers and companies who export such goods to EU countries.

Need for CBAM:

- To prevent “carbon leakage”:

- Carbon leakage is when companies relocate the production or manufacturing of carbon-intensive materials to countries with less stringent climate rules.

- This is to avoid restrictions on carbon emissions in their home country.

- To nudge behavioural change:

- According to WB, less than 4% of global emissions are currently under carbon pricing regimes as envisioned by the Paris Agreement.

- Most levies aren’t high enough to effect an actual change in polluter behaviour.

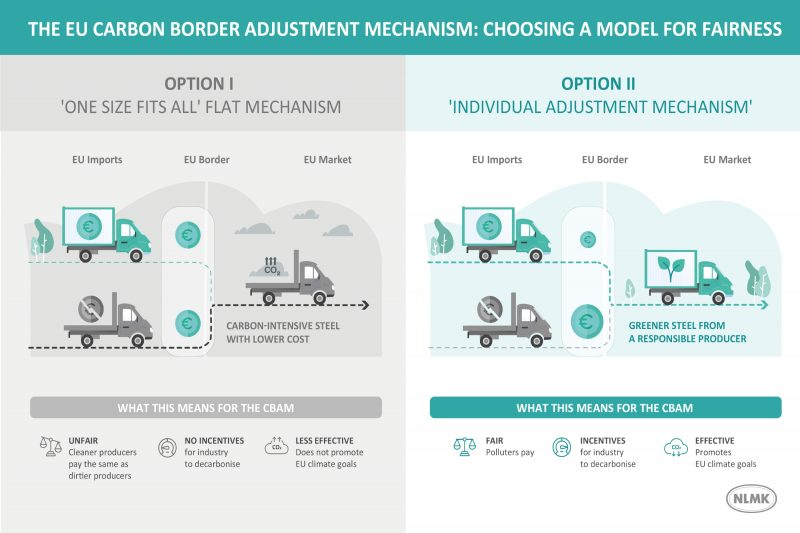

- Significance: By setting the price for the carbon content of goods regardless of where they are produced, it will create a level field for businesses inside the bloc and those outside.

Why are developing countries/India opposing CBAM?

- BRICS have opposed the measure, describing it as a unilateral, protectionist trade weapon that could lead to market distortion.

- For example, India has contended that the CBAM will translate into a 20-35% tariff on India’s exports, which now attract an MFN duty of less than 3%.

- Economic shock for countries reliant on one/more of the targeted industries.

- For example, Mozambique’s GDP would drop by about 1.5% due to the tariffs on aluminium exports alone.

- 27% of India’s exports ($8.2 billion) of steel, iron and aluminium products head to the EU.

- Way ahead: Funds from the sale of the CBAM levy can be diverted to support climate action efforts in less developed countries. This will guarantee both climate justice and the achievement of carbon emission targets.

Various Dimensions of India-Maldives Relations:

| Dimension | Example |

| Historical | The Maldives has a history intertwined with India, including conquest by Rajaraja Chola’s Chola dynasty (Maldives’ northern atolls). It became a British colony and gained independence in 1965, leading to political unrest. |

| Security Partnership | Joint Exercises – “Ekuverin”, “Dosti”, “Ekatha” and “Operation Shield” (begun in 2021). India provides the largest number of training opportunities for the Maldivian National Defence Force (MNDF), meeting around 70% of their defence training requirements. Maldives occupy an important position in India’s vision of ‘SAGAR’ (Security and Growth for All in the Region) and ‘Neighbourhood First’. |

| Economic Cooperation | India is Maldives’ 2nd largest trading partner. Afcons, an Indian company, signed a contract for the Greater Male Connectivity Project (GMCP) |

| Infrastructure Projects | Hanimaadhoo International Airport Development project under an Indian credit line. National College for Policing and Law Enforcement (NCPLE) was inaugurated by India’s External Affairs Minister (2022) |

| Grant Assistance | Grant assistance of 100 million Rufiyaa (currency of Maldives) for the High Impact Community Development Project (HICDP) scheme. |

| Sports and Education | Development of a sports complex in Gahdhoo, and academic collaboration between Maldives National University and Cochin University of Science and Technology. |

| Rehabilitation Centre | A drug detoxification and rehabilitation centre in Addu was built with Indian assistance. |

| China Factor | China’s strategic footprint in India’s neighbourhood has increased. The Maldives has emerged as an important ‘pearl’ in China’s “String of Pearls” construct in South Asia. Given the uncertain dynamics of Sino-Indian relations, China’s strategic presence in the Maldives remains a concern. |

Prelims Question for Practice

Mains Question for Practice

Chetan Bharat Learning is the best institute in Chandigarh for UPSC IAS ,PCS preparation. To know more about Chetan Bharat Learning’s Online & Classroom Courses, click on the following links:

Leave a Reply

You must be logged in to post a comment.