Why in the news?

Governor Shaktikanta Das said that permanent deletion of transactions can make the e-rupee or Central Bank Digital Currency (CBDC) become anonymous and make it at par with paper currency.

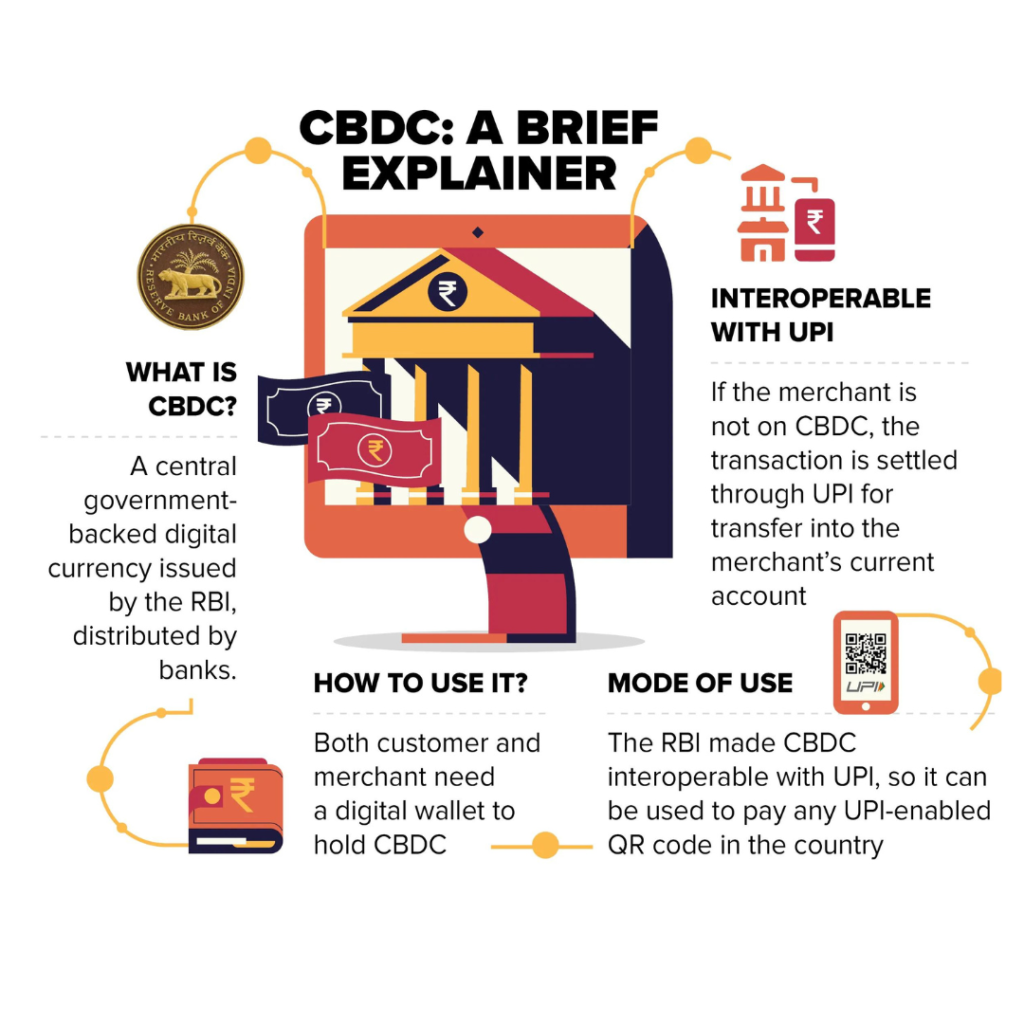

What is Central Bank Digital Currency (CBDC)?

- CBDC is a digital form of traditional paper currency issued by central banks.

- It maintains a one-to-one exchange rate with physical fiat currency, essentially being the digital equivalent.

A fiat currency is a national currency that is not pegged to the price of a commodity such as gold or silver.

- CBDC functions as electronic cash, offering a digital alternative to physical currency.

- Primarily designed for retail transactions, CBDC caters to everyday purchases and payments.

- It will potentially be accessible to a wide range of users, including individuals, businesses, and the private sector.

- CBDC helps to provide access to safe money for payment and settlement.

- As a direct liability of the central bank, CBDC is under its direct control and management.

- CBDCs, or digital fiat currency, can be traded using blockchain-supported wallets.

- While CBDC was influenced by Bitcoin, it differs from decentralised cryptocurrencies and digital assets.

- CBDC is issued by the state and has legal tender status, unlike decentralised virtual currencies.

Objectives of Central Bank Digital Currency:

- The primary goal is to reduce risks and expenses associated with managing physical currency, including dealing with worn-out notes, transportation, insurance, and logistics costs.

- Additionally, the aim is to encourage people to use CBDCs instead of cryptocurrencies for transferring money.

Global Trends

- The Bahamas introduced its nationwide CBDC, the Sand Dollar, in 2020, marking it as the first economy to do so.

- Nigeria also entered the CBDC arena with the launch of eNaira in the same year.

- China made headlines by piloting e-CNY, a digital currency, in April 2020, becoming the first major economy to embark on such a venture.

Significance

1. Cross Border Payments

- CBDCs can make payments across borders faster, cheaper, and safer.

- With CBDCs, payments can happen instantly, saving time and money.

- Better cross-border payments can help everyone, from individuals to whole economies.

- These improvements can boost global trade, help economies grow, and include more people in the financial system.

2. Financial Inclusion:

- CBDCs can help move informal economic activities into the formal sector.

- This shift can improve tax and regulatory compliance.

- CBDCs can also help more people access financial services.

- By using CBDCs, more individuals can become part of the formal financial system.

3. Traditional and Innovative

- CBDCs can change how we view money by lowering costs of handling physical currency.

- CBDCs offer a mix of benefits:

- They’re convenient and secure like cryptocurrencies.

- They’re also regulated and backed by reserves, like traditional bank money.

Challenges in Adopting CBDC Across India

- Privacy Concerns:

- The main concern is that central banks might collect a lot of data on user transactions, threatening privacy.

- Digital currencies won’t provide the same level of privacy as cash.

- Compromised credentials.

- Disintermediation of Banks

- If many people switch to CBDCs, banks might have less money to lend.

- If e-cash is widely used and the RBI allows unlimited money in mobile wallets, weaker banks could have trouble keeping inexpensive deposits.

- Other Risks:

- Technology becoming outdated quickly could be a problem for CBDCs, leading to expensive upgrades.

- Intermediaries might face risks as their staff need to learn how to work with CBDCs.

- There’s a higher risk of cyber attacks with CBDCs, so there’s a need for strong security measures which can be costly.

- Digital illiteracy.

Who can use the retail CBDC?

- A pilot project for retail CBDC will begin with select locations and banks within a closed user group (CUG) including customers and merchants.

- Initially, the pilot will cover four cities:

- Mumbai

- New Delhi

- Bengaluru

- Bhubaneswar.

- Four banks will participate in the initial launch–

- State Bank of India

- ICICI Bank

- Yes Bank

- IDFC First Bank

- The service will later expand to include more cities: Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, and Shimla.

- Four additional banks—Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank—will join the project at a later stage.

How will the retail digital rupee work?

- CBDC will be available in the same denominations as paper currency and coins, and banks will distribute it.

- Users can conduct transactions using a digital wallet stored on their mobile phones and devices.

- Transactions can be person-to-person (P2P) or person-to-merchant (P2M).

- Payments to merchants can be made using QR codes displayed at their locations.

- CBDC won’t earn interest and can be converted to other forms of money like bank deposits.

- The RBI has divided the digital rupee into two main categories: general purpose (for retail) and wholesale.

Way Forward:

- Central banks need to keep working on CBDCs, with help from financial institutions, tech experts, and others.

- Moreover, countries should team up on CBDC projects because cross-border payments involve different rules and challenges.

- CBDCs must be super safe and protect people’s privacy. That means strong cybersecurity to stop hacking and fraud, plus rules to keep user data private and secure.

Leave a Reply

You must be logged in to post a comment.