Important for

Prelims: Indian Economy

Mains: General Studies Paper III

What is in the News ?

- Recently, the Swiss government-brokered takeover of Credit Suisse by its larger rival UBS has wiped out the investment of AT 1 Bondsand created fear for AT1 bondholders.

https://www.wallstreetmojo.com/at1-bonds/

AT 1 Bonds

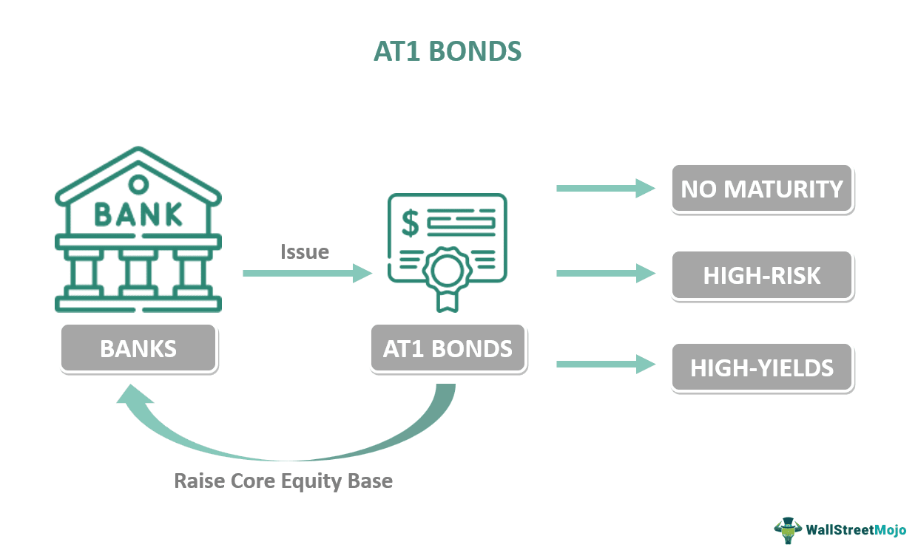

- AT1 bonds – sometimes known as contingent convertible bonds, or CoCos – are a type of debt issued by a bank that can be converted into equity if its capital levels fall below requirements.

- It was introduced after the global financial crisis of 2007-08, banks were asked to operate using their own permanent capital as opposed to borrowed capital.

- This permanent capital is termed Tier 1 capital

- Now, to shore up their Tier 1 capital, banks were allowed to raise a special class of bonds known as AT1 bonds from investors.

- AT1 bonds, like other bonds, pay regular interest. But they do not have a maturity date, as they are a permanent part of the bank’s capital, akin to equity.

- AT1 bonds are the riskiest bond as the issuing bank can skip premium and interest payout if it is falling short of capital.

Practice Questions for Prelims

Consider the following statements regarding AT 1 Bonds :

1.These can be issued by financial institutions to raise their Tier 1 capital to fulfil capital adequacy norms.

2. These are regular interest bearing instruments with no maturity date.

Which of the above statements is/are correct ?

a) 1 only

b) 2 only

c) Both 1 and 2

d) Neither 1 nor 2

Ans. c

Mains Practice Question

Leave a Reply

You must be logged in to post a comment.