Important for

Prelims: Science & Technology

Mains: General Studies Paper III

Aadhaar-enabled Payment System

- Cybercriminals have now taken to using silicone thumbs to operate biometric POS devices and biometric ATMs to drain users’ bank accounts.

AePS

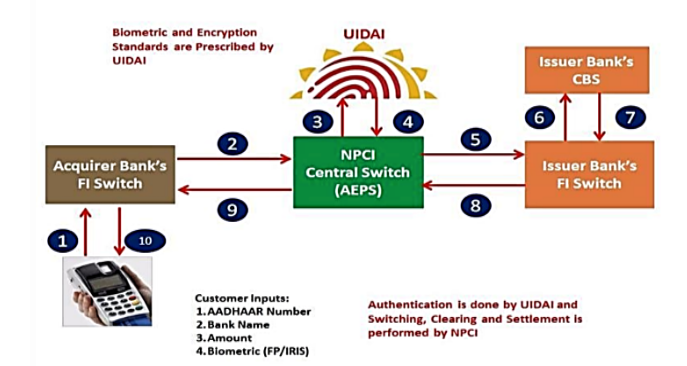

- Aadhaar-enabled Payment Services (AePS) is a bank-led model which allows online financial transactions at Point-of-Sale (PoS) and Micro ATMs through the business correspondent of any bank using Aadhaar authentication.

- The model removes the need for OTPs, bank account details, and other financial details. It allows fund transfers using only the bank name, Aadhaar number, and fingerprint captured during Aadhaar enrolment, according to the National Payments Corporation of India (NCPI).

How to make it more secure?

- The UIDAI is proposing an amendment to the Aadhaar (Sharing of Information) Regulations, 2016, which will require entities in possession of an Aadhaar number to not share details unless the Aadhaar numbers have been redacted or blacked out through appropriate means, both in print and electronic form.

- The UIDAI has also implemented a new two-factor authentication mechanism that uses a machine-learning-based security system, combining finger minutiae and finger image capture to check the liveness of a fingerprint.

- Users are also advised to ensure that they lock their Aadhaar information by visiting the UIDAI website or using the mobile app.

Practice Questions for Prelims

Mains Practice Question

Leave a Reply

You must be logged in to post a comment.